2023 Winter Newsletter: Community. Capital. Change

This past year was one of significant growth and renewed focus for Gratitude Railroad, as we marked 10 years since our founding and prepared for the next 10 years. We increased our staff; established our Board of Stewards; and updated and expanded our investment strategy and processes, applying key lessons from our history of impact investing.

Private markets, and specifically venture capital, had one of the most challenging years of the recent past, as monetary policy and other macroeconomic factors weighed on investors and entrepreneurs. We felt this in the form of slower dealflow, longer fundraising timeframes, and heightened attention to company valuations.

Against this backdrop, we continued to move capital into early-stage start-ups addressing social and environmental issues, and first-time impact funds with novel strategies and underrepresented managers. In doing so, we stayed the course with our careful assessment of fundamentals and long view on the potential for authentic impact and compelling financial returns. In response to both market conditions and the interests of our investor community, we also evaluated new opportunities in private credit, alternative ownership, and renewable energy.

Going forward, we expect market conditions to stabilize and improve, and the noise around “ESG investing” to soften. In 2024, we will continue to be active in industries and sectors where changes are accelerating, providing new opportunities for sustainable and equitable investing. We’re poised to grow our portfolio and scale our work toward demonstrating that business and entrepreneurs can help solve the most pressing issues and create long-term economic value.

We will continue to build and support a unique community of investors, entrepreneurs, and fund managers who learn together while collaboratively moving capital. Our network is growing and becoming more diverse, as we welcome investors engaging as individuals, family offices, foundations and RIAs. We have created new ways to participate in our investor community and invite you to join us in transforming capital to create a thriving world.

With Gratitude,

Rebekah Saul Butler and Thomas Knowles

Table of Contents

Diversity, Equity, and Inclusion

WHAT’S NEW AT GRATITUDE: The Year In Review

Celebrated Ten Years of Impact Investing: This year marked 10 years since our founding – a decade dedicated to transforming capital to create a thriving world.

In mid-October, we made an organizational announcement commemorating a decade of Gratitude Railroad and outlining organizational changes we have made. Explore the full announcement “Imagine the Future: The Next Ten Years of Gratitude Railroad.”

Grew Our Values Aligned Team: We welcomed three new staff members, expanding our investment, operations, and impact capacity.

Our new staff members bring experience in investing, finance and operations, strategy, and impact, drawing from previous roles at The Grove Foundation, Silicon Valley Bank, and Black Rock.

Rebekah Saul Butler, Managing Partner

Walter Washington Jr, Investment Associate

Mokutima Ekong, Operations Analyst

Expanded our Board of Stewards: We are honored that Aaron Walker, a long-time collaborator and impact investing leader, joined our Board of Stewards.

As the Founder of Ruthless for Good Fund, a $30M pre-seed and seed stage fund, Aaron brings a wealth of experience investing in BIPOC and women founders who are shaping the future of work, education, and access innovations. He was also Founder and CEO at Camelback Ventures, a mission-driven organization creating a more diverse social innovation ecosystem, where he supported nearly 100 investments to raise over $120 million dollars. Aaron’s unique perspective, shaped by his background as a classroom teacher and practicing attorney, emphasizes belief in good people, dedication to service, and a strategic approach to resolving challenges in entrepreneurship. We are grateful to have Aaron as a member of our ten-person Board of Stewards.

Hosted Annual Investor Gathering at 1440 Multiversity: This marked the first time we convened our community in California for this event.

For the first time since its initiation, the Gratitude Investor Gathering took place outside of Utah, at 1440 Multiversity – a 75-acre state-of-the-art learning and retreat center in Northern California. Our theme, Shared Future, encouraged attendees to think about the collaboration across individuals and institutions that is needed to shape an equitable and thriving world. Filmmaker Nic Askew was in attendance to capture footage, as part of a film he is making on the role capital plays in shaping the direction of humanity and how people become impact investors [coming in Spring 2024]. We invite you to view an interim slideshow Nic put together, Voices from the Gratitude Railroad Investor Community.

INVESTMENTS

We invest in early-stage companies and emerging funds with a dual focus on compelling financial returns and authentic impact. Our investments address at least one of our core themes: Planetary Health [renewables and natural systems], Social Wellbeing [health, education, and wealth equity], and Intersectional Innovations [food systems and climate justice].

Recent Investments

Mae is a culturally competent digital health platform connecting Black expectant mothers with critical resources to drive positive pregnancy outcomes. Mae works in concert with healthcare payers and states to address the significant disparities in maternal health outcomes for Black expectant mothers across the country.

Glacier is the creator of an affordable, high-performing, and space-efficient AI-enabled robot and camera that picks and sorts recycling. Glacier’s robot is 60% cheaper and 30% of the size of competitors. It also provides actionable data analytics and licenses data packages from recycling facilities to third parties such as brands and municipalities.

Blue Ocean Gear produces sensor-rich, rugged smart buoys that allow fishers to track and monitor their gear via satellite or radio using BOG’s software, reducing gear loss (and consequently, plastic in the ocean) and enabling more efficient fishing. Their network of buoys collects real-time data on ocean conditions, which fishers and other third parties operating in the ocean can use.

Voyager is a female founded and led fund that invests in technology companies creating the future of mobility, energy, materials, food, the built environment, analytics, industrial systems, and carbon removal.

Company Spotlight: Twentyeight Health

Meet Twentyeight Health, a company on a mission to bring equity to sexual and reproductive health, by increasing access, convenience and affordability to underserved communities through an extensive telehealth platform. Through strategic business acquisitions and meaningful Medicaid partnerships, Twentyeight Health has doubled its annual recurring revenue since Gratitude Railroad’s investment.

Although 95% of women have insurance, only 30% actively engage with the healthcare system, leaving 38 million women in the U.S. encountering obstacles in accessing adequate healthcare services. Barriers are particularly pronounced for low-income and BIPOC women seeking sexual and reproductive health care, including contraceptive services, STI prevention and treatment, obstetrical care, and other reproductive healthcare services. These challenges stem from a complex interplay of cultural and social determinants, coverage issues, provider shortages, inadequate sexual education, and the stigma surrounding reproductive care.

Utilizing a proprietary network of pharmacy partners and experienced physicians, Twentyeight Health’s platform ensures rapid delivery of medications, available for pickup or delivery. A curated network of physicians brings significant experience working with Medicaid patients, and services are accessible in both English and Spanish through a user-friendly text-based digital experience, prioritizing ease, convenience, and equitable access.

Why We Invested in TwentyEight Health:

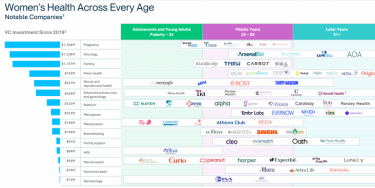

Flourishing Market Opportunity: Since 2016, FemTech has surged as a high-growth sector in digital health, fostering opportunities for social progress and value creation. Global revenue stands at $55.14B, set to hit $103B by 2030. Despite this, FemTech companies receive just 3% of digital health funding, even as the U.S. market revenue is expected to grow at a 15% CAGR, reaching $3.8B by 2031. These companies challenge traditional healthcare models, providing culturally sensitive care for vulnerable populations and drawing attention from payers and providers aiming for more effective consumer engagement.

Improved Health Outcomes for BIPOC and Low-Income Communities of Women: Twentyeight Health addresses a critical gap in women’s health by providing accessible reproductive and sexual healthcare for Medicaid-insured women. With 58% BIPOC users, 55% Medicaid users, and 84 NPS (three times the national average for this customer experience indicator), the platform focuses on crucial areas like pregnancy prevention, sexual health, and prenatal/ postpartum care. Through this comprehensive approach, Twentyeight Health is bridging healthcare disparities and improving outcomes for diverse communities.

Strong DTC and Medicaid Traction: Twentyeight Health’s early traction in the direct-to-consumer space facilitated the establishment of a sizable customer base, generating valuable patient engagement and outcome data. A notable 55% of users come through referrals from organizations working with Medicaid and BIPOC populations. Successful partnerships with Aetna and Molina underscore Twentyeight’s efficacy in providing immediate value to large Medicaid plans, offering a potential solution to challenges in reaching underserved populations, particularly in prenatal care, and positioning the company as a data-driven ally for improved care coordination and cost reduction for payers.

Portfolio Updates

Mango Materials celebrates opening of its Launch Facility in Vacaville

Mango Materials hosted a ribbon-cutting ceremony this fall to mark the opening of its Launch Facility at the Easterly Wastewater Treatment Plant in Vacaville, California, the first phase of a partnership validating the use of Easterly’s biogas as a feedstock in a proprietary process to produce YOPP+ biopolymer pellets as a replacement for polluting plastics.

Twentyeight Health featured in SVB’s 2023 Innovation in Women’s Health Report

SVB’s inaugural Innovation in Women’s Health Report unveils an optimistic outlook for an undervalued and rapidly growing sector. Twentyeight Health was featured as a notable company in sexual and reproductive health, earning them a spot next to fellow portfolio company Mae.

Springbank’s Elana Berkowitz on Bloomberg News

Springbank Collective’s Founding Partner Elana Berkowitz joined Bloomberg News to discuss the opportunities that technology presents to make care more affordable, efficient, and consistent in the future.

First Women’s Bank named Fast Company’s “On the Rise – Brands that Matter”

The Fast Company’s Brands that Matter list recognized First Women’s Bank as the only women-founded, -owned, and -led national commercial bank in the country, with a strategic focus on closing the gender-lending gap.

Pallet founder Amy King spoke at the Bipartisan Policy Center’s event: Prioritizing Housing and Health to Prevent and Address Homelessness

Amy King, founder of Pallet, spoke to top elected city officials and business and community leaders on how to scale up promising and innovative interventions in collaboration with local and federal governments.

Portfolio Job Board

- Account Executive – Glacier

- Care Advocate & Community and User Engagement Manager – Carallel

- Director of Payer Partnerships & Manager of Strategic Projects – Twentyeight Health

- Multiple roles – SmartLam North America

- Multiple roles – PosiGen

- Services Specialist – Recompose

COMMUNITY AND EVENTS

In 2023, we convened nearly 800 unique investors, fund managers, entrepreneurs, thought leaders, and academics, in a variety of collaborative learning events.

Over the past year, we hosted a total of 40 events, including in Seattle, Chicago, Boston, San Francisco, Denver, Los Angeles, Jackson Hole, New Orleans, and New York. These events took different shapes, including investment meetings, portfolio company site visits, dedicated founder hours, and virtual roundtables on investment topics such as the care economy, health equity, and the energy transition.

Scotts Valley, CA

Chicago, IL

Scotts Valley, CA

Los Angeles, CA

New Orleans, LA

Seattle, WA

Upcoming Events

In 2024 we plan to host a series of virtual events as well as in-person convenings across the country, including in New York, Connecticut, Massachusetts, California, Colorado, New Mexico, Georgia, Washington D.C. and Texas.

These events will include investment meetings and portfolio reviews, our annual investor gathering, an LP Summit, portfolio site visits, founder hours, expert hours, investor dinners, happy hours, and roundtables on education, food systems, and waste management.

If you are interested in connecting or collaborating around these events, please reach out.

Save the Date! 2024 Gratitude Investor Gathering

Our annual convening of investors, thought leaders, fund managers, and entrepreneurs will once again take place at 1440 Multiversity, from Tuesday, November 12 – Friday, November 15. This invite-only event will be capped at 125 guests to ensure meaningful connection and collaboration. If you are an accredited investor interested in learning more, please email Olivia Kronemeyer [email protected]

Past Events

Funding the Future of Care in Chicago: An Evening of Conversation About Supporting Women, Caregivers, Families, and Communities

Last month we collaborated with Good Chaos to bring together Chicago-based impact investors for an evening of networking and shared learning focused on the care economy. The panel conversation, moderated by Gratitude’s Managing Partner, Thomas Knowles, featured two portfolio founders, Maya Hardigan of Mae, and Shara Cohen of Carallel, as well as Ashley Bittner, GP of Firework Ventures, an early-stage fund. The guest speakers discussed the multifaceted nature of the care economy, the importance of implementing a holistic approach for enduring impact, and how to navigate complexities in healthcare, policy, and funding. Watch the recording here.

Shifting Winds on the Investment Landscape: Harnessing Opportunities Created by the Energy Transition

On December 6th, we hosted a virtual roundtable in collaboration with Fiduciary Trust International. We drew from the findings and analysis presented in FTI’s new report, ‘Plugging into the Energy Transition: Harnessing Clean Energy Investments from Emerging Technologies to Proven Solutions’. Energy investment experts Frances Aderhold, Charlie Donovan, and Andy Lubershane discussed key drivers, opportunities and challenges presented by the energy transition. Moderated by Tanya Khotin, the conversation emphasized the need for investment across asset classes, and highlighted sector innovations, including the tangible impact of green initiatives, electrification, and industrial de-carbonization. Watch the recording here.

DIVERSITY, EQUITY, AND INCLUSION

Our commitment to diversity, equity, and inclusion remains integral to both our investment initiatives and community programming. All of our investments this year had at least one female founder, and 50% had at least one BIPOC founder. Across our 36 direct investments, 58% are women-led or founded, and one-third are BIPOC-led or founded. We continue to focus our Inclusive Capital Strategy on first-time emerging managers, with an explicit gender and racial equity lens.

We believe in engaging our investor community in this important work. We co-hosted two workshops focused on investing with an equity lens, one led by Erika Seth Davies of the Racial Equity Asset Lab [REAL] and Rhia Ventures. Erika’s session focused on shifting investor decision-making and highlighted resources on how to build more inclusive investment processes. We also partnered with Capital Collaborative to host a training on how trauma shows up within investment dynamics.

Links to Inspire

Empowering Education by Navigating Chronic Absenteeism with Joanna Smith-Griffin

On this podcast Joanna talks about her involvement in education and the ed-tech space. Joanna also talks about the impacts of chronic absenteeism and how AllHere strategically addresses this challenge, offering valuable insights into the platform’s role in supporting student success.

McKinsey’s COP28 Insights: What Would It Take to Scale Critical Climate Technologies

The global management consulting firm published a number of insights related to the UN’s annual conference on climate change. This report dives into the critical need to accelerate and scale up climate technology and what will be required to do so.

Alpha in Impact: Strengthening Outcomes Impact and Financial Value at Exit

This report, released by Impact Capital Managers, Morrison Foerster, and Research Fellow Divya Walia, explores how an impact-focused approach can generate alpha for investors. The study, based on 230 exits from market-rate impact funds, identifies key drivers of success.

Join Us

We invite you to join us in transforming capital to create a thriving world.

There are multiple ways to engage in our community, learn, and invest. We look forward to partnering with you in 2024!

Learn More