Why We Are Excited About Investing in Healthcare

Healthcare can be a surprisingly challenging area for impact investors. On the one hand, health-related businesses often have some inherent social good – such as improving treatment, making healthcare more efficient, or expanding access to care. On the other hand, new drugs, devices, and technologies risk driving up costs and exacerbating inequities, with little or no marginal benefit, depending on how they are priced, distributed, covered and utilized. In addition, health-related innovations have long and sometimes winding paths due to federal agency approval processes and the complex relationships between providers, payers, and patients.

Yet, the healthcare markets remain vast, and the potential for companies and innovations to reduce inequalities and improve lives is similarly immense. As a result, Gratitude Railroad has long tracked opportunities in the space that would be a good fit for our investment thesis, which combines health equity objectives with our focus on early-stage companies and the potential for compelling financial returns (see Figure 1).

Our Health Equity Thesis

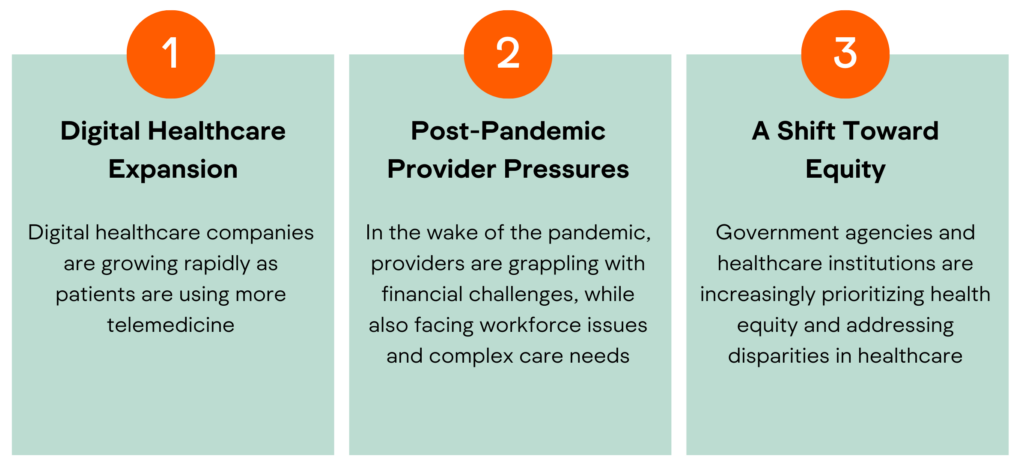

In the past, we evaluated and invested in a select number of healthcare companies, including Cadence OTC, Carallel, and Twentyeight Health, focusing on digital solutions and compelling impact. Over the last couple of years, there have been shifts in the sector that are stimulating business models that align in new ways with our thesis – from both impact and financial perspectives – creating exciting opportunities for our investor community. These shifts are wide ranging and complex, but the most significant developments include (also see Figure 2):

The growth of digital healthcare. Digital healthcare expanded significantly over the last few years, as changes in care patterns brought about by the pandemic intersected with the coming-of-age of key technologies now widely utilized in healthcare. As evidence of this shift, in 2022, nearly 40% of adults relied on telemedicine and over 80% of MDs offered telehealth.

Post-pandemic provider pressures. In the wake of the pandemic, providers find themselves struggling financially as they cope with years of higher costs, reduced revenue, and higher levels of uninsurance, among other challenges. In addition, many clinicians experienced burnout due to the pandemic, leading to workforce shortages. Patient care also grew more complex with the advent of long covid and increased mental health needs. Learn more.

A shift toward equity. Meanwhile, heightened attention to health disparities driven by race, gender, and income led to a shift in equity-focused policies by agencies, payers and providers. At the federal level, for example, the Centers for Medicare and Medicaid Services introduced a framework to increase providers’ incentives to deliver more equitable care; and the National Center for Quality Assurance launched an accreditation program focused on health equity.

Three Interrelated Trends

Business Model Implications

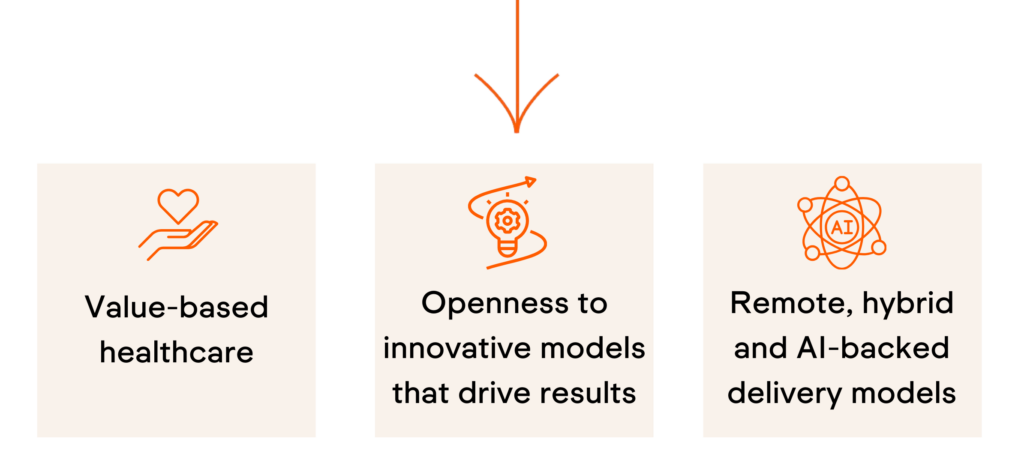

These shifts in turn have led to a greater focus on B2B solutions for value-based care, a renewed openness to innovation, and a resurgence of companies creating remote, hybrid and AI-driven care platforms (B2B and B2C) – with heightened attention to (and financial incentives for) serving historically underserved populations. Businesses leveraging these strategies commonly utilize software and have the potential to scale quickly (hallmarks of venture-backed companies). Notably, in 2023 venture fundraising among healthcare companies grew to nearly $7B quarterly after a slow 2022, an indication of the dynamic nature of this market.

In 2023, we saw all of these innovations as we reviewed 50 healthcare companies through our dealflow process. We subcategorized them as reproductive health, social determinants of health, mental health, and/or care economy – reflecting the breadth of focus areas. One company that we invested in, Mae (see Figure 3), elucidates several shifts noted above and the concomitant fit with our health equity objectives. Mae utilizes a hybrid care delivery platform, leverages Medicaid and other funds aiming to address health disparities with innovative models, and has an eye toward value-based care.

Meet Mae:

A trusted digital-first health platform for Black women

Mae is an on-demand, culturally competent healthcare platform that supports Black expectant mothers with critical resources throughout pregnancy, labor & delivery, and postpartum via a digital platform and in-person support from pre-vetted doulas.

Why we invested:

- Highly qualified management team with lived experience

- Impressive contracting traction

- Differentiated product with high impact

Progress to date:

- Live with seven Medicaid insurance plans

- Executed Health and Wellness contract with a large national retailer

Impact to date:

- 30% reduction in pre-term birth rates

- 35% reduction in C-section rates

Figure 3

Going forward, Gratitude Railroad will continue to approach the healthcare sector with some caution, letting investors with different capacities evaluate highly specialized and regulated arenas, and minding the “noise” and saturation in the digital healthcare area as new companies crowd into the space. Still, we are excited about the way that technology is being used to address gaps and the policy shifts that sharpen the focus on health equity. This is clearly creating new opportunities to support innovative business models and founders with deep competency in underserved patient populations. Add to the mix a more positive macroeconomic environment for early-stage investments and new funds bringing deep expertise to the space (such as our portfolio fund, Bright Ventures, who was a seed investor in Mae), and the future is promising for impact investors focusing on healthcare and equity in 2024 and beyond.